A Company's Effective Tax Rate Can Best Be Described as:

A companys effective tax rate can best be described as. The companys cash taxes paid divided by taxable income B.

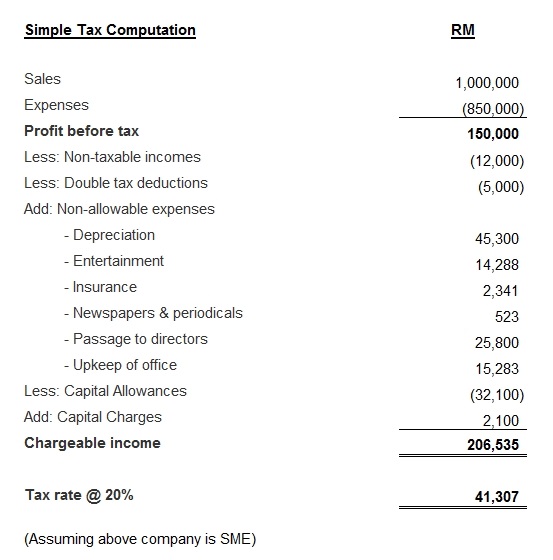

Nbc Group How To Calculate Tax Estimate For Cp204

The effective tax rate is stated as the average rate at which an individual is taxed on the income heshe has earned or the average rate at which a firm is taxed on pre-tax profits.

. A companys effective tax rate can best be described as. The companys cash taxes paid divided by taxable income. The companys financial statement income tax provision divided by taxable income D.

Corning received tax refunds 2008 2009 and 2010 due to an US. The companys cash taxes paid divided by taxable income. A companys effective tax rate can best be described as.

The companys financial statement income tax provision divided by taxable income. The method used to calculate the median effective tax rates is described below. A companys effective tax rate can best be described as.

The effective tax rate for a corporation is the average rate at which its pre-tax profits are taxed while the statutory tax rate is the legal. A companys effective tax rate can best be described as. The companys cash taxes paid divided by net income from continuing operations C.

The companys financial statement income tax provision divided by taxable income. ACNT 1347 Corp Tax Ch 17 TB. T will also record a DTA because the capital loss carryforward will cause taxable income to be lower in the future relative to future financial income as Table 1.

Multiple Choice The companys cash taxes paid divided by taxable income. The companys financial statement income tax provision divided by taxable income. The companys cash taxes paid divided by net income from continuing operations C.

The companys cash taxes paid divided by net income from continuing operations. The companys financial statement income tax provision divided by net. Effective Tax Rate Total tax expense Taxable income.

The companys financial statement income tax provision divided by net income from continuing operations. THIS SET IS OFTEN IN FOLDERS WITH. In 2011 their effective tax rate soared to 36 and Susan Ford vice president of tax at the.

The effective tax rate is stated as the average rate at which an individual is taxed on the income heshe has earned or the average rate at which a firm is taxed on pre-tax profits. The companys cash taxes paid divided by taxable income. For example using Schedule X below youll note that all single taxpayers regardless of level of.

For example for a single filer the 2021 LTCG tax rate is 0 for incomes up to 40400 and 15 for incomes from 40401 to 445850. Long-term capital gains LTCG tax rates for tax year 2021. The effective tax rate can be defined as the average rate of tax payable by an organization or person.

The companys cash taxes paid divided by pre-tax book income. But I cant find any explanation whether these tax rates are marginal or effective. The companys cash taxes paid divided by net income from continuing operations.

The companys cash taxes paid divided by net income from continuing operations. Ive found many sites that list the current US. The companys cash taxes paid divided by net income from continuing operations.

If you look at the tax rate schedule you can see this pretty clearly. T and P will each calculate current tax liability and expense by multiplying taxable income by the 21 corporate tax rate enacted in the law known as the Tax Cuts and Jobs Act TCJA PL. With respect to its marginal rate a sales tax is best described as Aregressive B.

This problem has been solved. It is the actual amount of federal income tax payable on a persons income excluding self-employment taxes local and state taxes and FICA taxes. A companys effective tax rate can best be described as.

A companys effective tax rate can best be described as. The companys cash taxes paid divided by taxable income B. See the answer See the answer See the answer done loading.

The companys financial statement income tax provision divided by taxable income. The companys financial statement income tax provision divided by taxable income. Research development tax credit.

A firms effective tax rate can be described as the firms financial statement income tax provision divided by the firms net income earned from continuing operations. The companys financial statement income tax provision. The companys financial statement income tax provision divided by taxable income D.

125000 600000. Total tax expense 100000 10 200000 15 200000 25 100000 35. For corporations the effective tax rate can be found by dividing the tax expense by the earnings before tax of the company.

Has a corporate tax rate of 21 but many companies. The companys cash taxes paid divided by taxable income. A companys effective tax rate can best be described as.

Therefore the calculation of this formula will be as follows. For Alphabet Inc Googles holding company the market capitalization shown is for the companys combined Class. That figure has declined over time to around 23 as of last year.

A firms effective tax rate can be described as the firms financial statement income tax provision divided by the firms net income earned from continuing operations. In 1980 the average worldwide corporate tax rate was 40.

Income Tax Rate On Private Limited Company Fy 2021 22 Ay 2022 23

Comments

Post a Comment